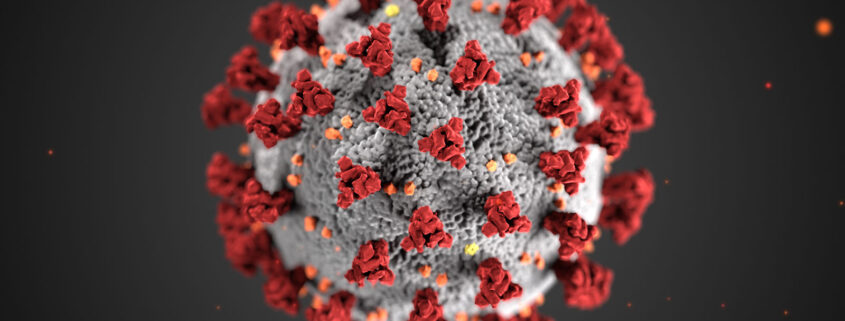

FALL 2020 – COVID-19 Tax Law Changes

Everyone has been impacted by the 2020 pandemic in ways too numerous to count. As a result, the nation’s tax laws have changed, and may continue to change, with the intent of helping taxpayers bear the brunt of the negative economic impact of the virus. Here are some highlights of tax law changes that may impact you.

There is much uncertainty around Trump’s executive order on Aug 8, 2020 calling for the suspension of the employee’s share of Soc Sec and Medicare taxes through the end of the year. At present, this seems to be a deferral of the tax that will have to be repaid at a later date. Obviously this would not apply to ministers, who do not have these taxes withheld on a paycheck. The executive order is silent on whether this applies to self-employment tax that ministers and other self-employed people must pay. Tax professionals recommend that you continue to set aside funds and pay your 2020 estimated tax as planned.

CARES Act, Economic Impact Payments that were issued in the Spring and Summer will not be taxable, but will have to be reported on your 2020 tax return as a tax credit. Therefore, have ready the amount you received when it comes time for your 2020 tax preparation.

CARES Act, Charitable contributions – Ministers and parishioners are typically generous givers, but for most taxpayers, their standard deduction is now greater than their Sch A (itemized deductions where contributions are reported). For 2020, there is now an “above the line” deduction for contributions up to $300, for those who take the standard deduction.

CARES Act, Retirement Account changes – Required minimum distributions from retirement accounts are waived for 2020. Those who took an RMD between Jan 1 and June 30 have until August 31, 2020 to repay/rollover the distributed funds back into the IRA or retirement plan, and avoid paying tax on the distribution. If you need the money, keep it! Just be aware that the distributions will be taxed as usual.

There are additional relief measures to those who have been adversely affected by COVID-19.

For additional information, check out www.irs.gov/coronavirus